Introduction

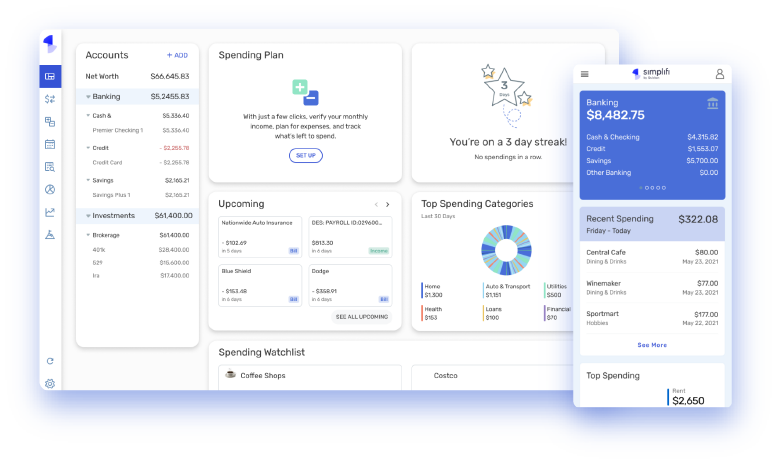

Managing money as a couple can reduce stress, align goals, and build wealth together, but mismatched spending habits often spark arguments. The best free budgeting apps for couples review highlights tools that enable joint tracking, bill splitting, and transparent communication without fees. From dedicated couple-focused apps to versatile free versions, these options sync accounts, set shared goals, and provide real-time insights. Based on user ratings, expert reviews, and updates, we evaluate top free or freemium apps for seamless collaboration. Whether newlyweds or long-term partners, these apps foster financial harmony.

Why Couples Need Dedicated Budgeting Apps

Money issues rank among top relationship stressors, but shared apps promote transparency and teamwork. Features like joint views, chat for transactions, and customizable sharing (individual vs. shared expenses) make them superior to solo apps. In this best free budgeting apps for couples review, we prioritize no-cost options with strong couple tools, high ratings (4+ stars), and privacy controls. Free tiers suffice for most, though premiums unlock extras like auto-sync.

Top Pick: Honeydue – Best Overall Free App for Couples

Honeydue leads as the dedicated free app for couples, allowing separate and joint account views, bill reminders, and in-app chat for expense discussions.

Users praise privacy options and emoji reactions. Pros: 100% free, joint cash card, supports investments/loans. Cons: Ads, U.S.-focused syncing. Ideal for modern couples mixing personal and shared finances.

Goodbudget – Best for Envelope Budgeting

Goodbudget digitizes the envelope system, allocating money to categories with shared access across devices.

Free tier offers 20 envelopes—ample for basics. Pros: Debt tracking, manual entry avoids sync issues, cross-platform. Cons: Limited envelopes free, no auto-import. Great for debt payoff or cash-like discipline.

EveryDollar – Best Zero-Based Budgeting Free Version

Dave Ramsey's EveryDollar uses zero-based budgeting with a solid free tier for manual planning and sharing.

Log in simultaneously on devices. Pros: Simple, goal-focused, no ads in free. Cons: Premium for auto-sync. Suits Ramsey followers planning every dollar.

Splitwise – Best for Splitting Bills and Expenses

Splitwise excels at tracking shared costs like rent or trips, settling via integrations.

Pros: Free, fair splitting, group support. Cons: Not full budgeting. Perfect for roommates-turned-partners.

PocketGuard Free – Best for Basic Tracking and Insights

PocketGuard's free version tracks spending, sets limits, and shares views. Pros: Bill reminders, "In My Pocket" leftover. Cons: Limited free sync. Good entry-level with insights.

Other Notable Mentions

Zeta offers joint tools with privacy; Buddy simplifies shared budgets. Empower (free) aggregates but lacks deep couple features.

How to Choose the Right App

Consider needs: Full joint (Honeydue), envelope (Goodbudget), or splitting (Splitwise). Check iOS/Android compatibility, privacy, and ease. Start free—most allow testing.

Tips for Success as a Couple

Discuss goals first, set shared categories, review weekly, celebrate milestones. Apps reduce arguments with transparency.

Conclusion

This best free budgeting apps for couples review shows Honeydue as top for dedicated features, with Goodbudget and EveryDollar strong alternatives. Free options empower financial teamwork without cost. Download one today—stronger finances mean stronger relationships.