Financial Independence = Your investments can cover your living expenses forever. Retire Early = Optional. Many “FIRE” people keep working or start passion businesses.

The 3 main versions

- Lean FIRE: ~$1–1.5 M portfolio (frugal lifestyle)

- Classic FIRE: $1.5–3 M (comfortable middle-class life)

- Fat FIRE: $3–10 M+ (luxury, private schools, travel)

The One Formula That Rules Everything

FI Number = Annual Expenses ÷ Safe Withdrawal Rate 2025 safe withdrawal rate: 3.3–4 % (most people use 3.5 %) Example: You spend $60,000/year → FI Number = $60,000 ÷ 0.035 = $1.71 million

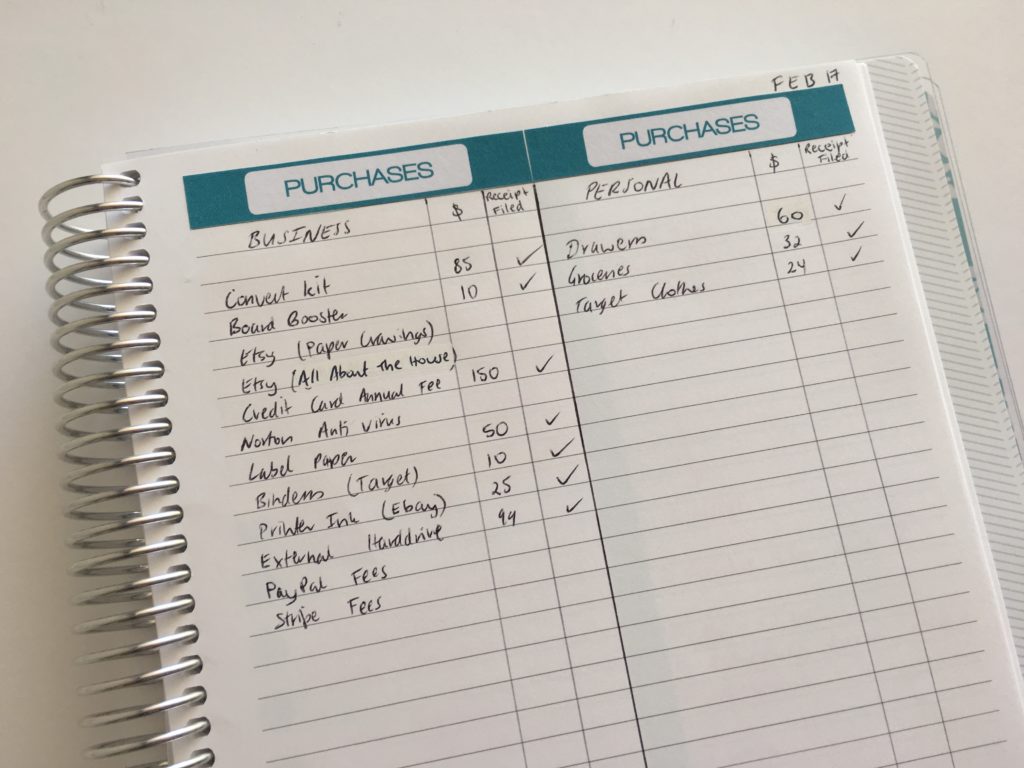

Step 1 – Track Your Money (Week 1)

You can’t improve what you don’t measure.

- Use free tools: Mint, YNAB, Monarch Money, or simple Google Sheet

- Track every dollar for 30–60 days

- Most people discover they spend $800–$2,000/month on “nothing”

Step 2 – Calculate Your Real FIRE Number (Week 2)

Honest annual spending in 4 buckets

- Essentials (housing, food, transport, insurance)

- Fun (travel, dining, hobbies)

- Buffer (healthcare, gifts, car replacement)

- Future goals (kids’ college, parents, dream house)

2025 average numbers

- Single, city: $45–70 k/year

- Couple, suburbs: $60–90 k/year

- Family of 4: $90–150 k/year

Step 3 – Boost Your Savings Rate (The Real Secret)

Savings Rate = (Income – Expenses) ÷ Income The higher your rate, the faster you reach FIRE.

| Savings Rate | Years to FIRE (from $0) | Starting age 30 → FIRE age |

|---|---|---|

| 20 % | 37 years | 67 (normal retirement) |

| 40 % | 22 years | 52 |

| 50 % | 17 years | 47 |

| 60 % | 12 years | 42 |

| 70 % | 8.5 years | 38.5 |

Most 2025 FIRE people hit 50–65 % by living on one income while earning two.

Step 4 – The 2025 Income-Expense Hacks That Actually Work

Cut the big 3 ruthlessly

- Housing <25 % of take-home (rent or mortgage)

- Transport: one paid-off car or public transport

- Food: cook 80 %, eat out 20 %

Quick wins that add $10–30 k/year

- Refinance mortgage/student loans to 2025 low rates

- Switch to high-yield savings (4.5–5.3 % APY)

- Max 401(k)/IRA/HSA (triple tax advantage)

- Side hustle 5–15 hrs/week ($10–50 k extra)

Step 5 – Where to Put the Money (The 2025 Portfolio)

Simple 3-fund lazy portfolio used by 90 % of FIRE people

- 60–80 % Global stocks (VTI + VXUS or just VT)

- 20–40 % Bonds (BND or cash if <5 years to FIRE)

- 0–10 % Bitcoin/REITs/crypto (optional, small %)

Historical return ~7–9 % after inflation → supports 3.5 % withdrawal forever.

Step 6 – The Exact Milestones Most People Follow

Coast FI → $500 k–$800 k invested (enough to grow to FI without adding more) Half FI → 50 % of your number Barista FI → $1–1.5 M + part-time job for health insurance Full FIRE → 25–30× expenses invested

2025 Real-Life Examples

- Maya, 34, teacher, $68 k salary → saves 62 % → FI number $1.6 M → on track age 43

- Alex & Sam, couple, $160 k household → cut housing from $3,800 → $1,800 → savings rate 68 % → FIRE in 9 years

- Raj, 29, tech → $130 k salary → lives on $40 k → saves $90 k/year → FIRE age 37

The 90-Day FIRE Starter Plan

Month 1

- Track every expense

- Calculate FI number

- Open high-yield savings + brokerage

Month 2

- Cut one big expense (car, housing, subscriptions)

- Automate 401(k) + IRA max

- Start $200–$500/month side hustle

Month 3

- Build 3–6 month emergency fund

- Invest first $5 k–$10 k in index funds

- Join a FIRE community (ChooseFI Facebook, Reddit r/financialindependence)

Common Mistakes Beginners Make (Avoid These)

- Lifestyle inflation after every raise

- Trying to pick individual stocks

- Counting on inheritance or “big exit”

- Ignoring healthcare before Medicare (age 65)

- Quitting job the second portfolio hits number (have 12–24 months cash first)

The 2025 FIRE Resources That Actually Help

Free

- Mr. Money Mustache (blog)

- ChooseFI podcast

- Mad Fientist

- JL Collins “The Simple Path to Wealth”

Paid (worth it)

- YNAB ($99/year)

- CampFI weekends ($400–$600)

- “Playing with FIRE” documentary

Final Thoughts

FIRE isn’t about deprivation. It’s about intentionally designing a life where money works for you instead of the other way around.

You don’t need a six-figure salary. You need a plan, consistency, and the willingness to question every “normal” expense.

Start tonight: open a spreadsheet, write your current monthly expenses, multiply by 300 (25× rule). That number is your freedom.

Most people look at it and feel overwhelmed. FIRE people look at it and start saving tomorrow.

Which one will you be?